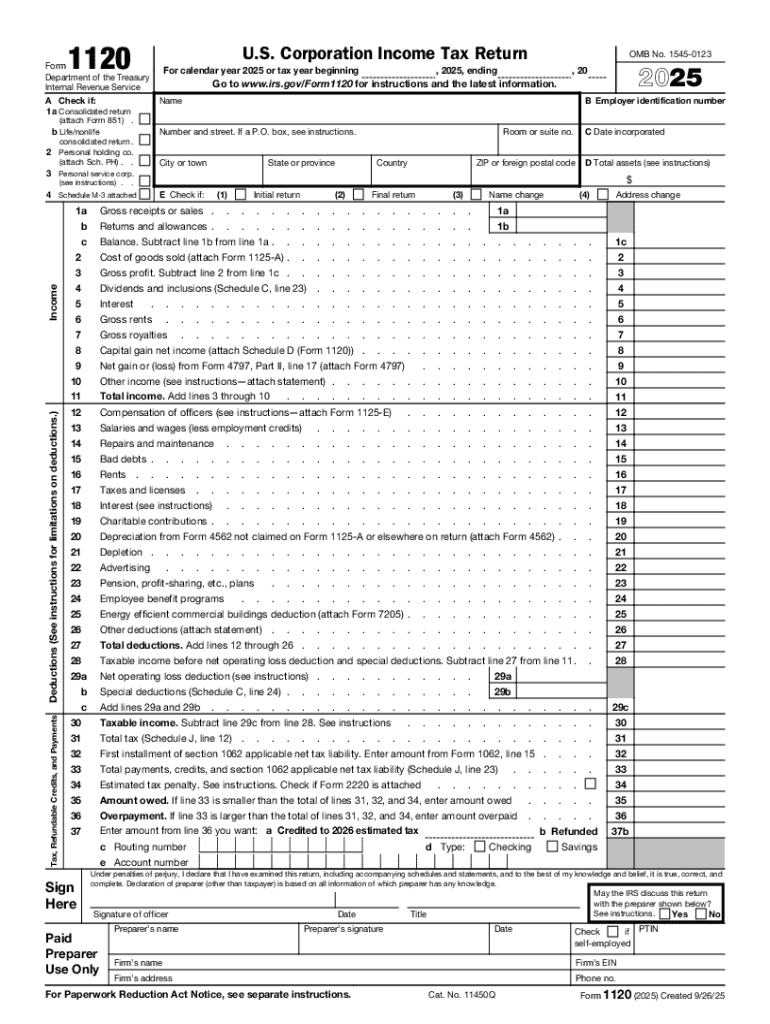

IRS 1120 2025-2026 free printable template

Instructions and Help about IRS 1120

How to edit IRS 1120

How to fill out IRS 1120

Latest updates to IRS 1120

All You Need to Know About IRS 1120

What is IRS 1120?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120

How can I correct mistakes made on my filed IRS 1120?

If you find an error after submitting your IRS 1120, you can file an amended return using Form 1120-X. This allows you to correct any mistakes made in your original filing, ensuring your business's tax information is accurate. Keep in mind that the IRS requires you to attach any necessary documentation that supports your corrections.

What should I do if my e-filed IRS 1120 is rejected?

If your IRS 1120 is rejected when e-filing, review the rejection notice for specific codes indicating the issue. Common errors include missing information or incorrect formats. Once you have corrected the mistakes, you can resubmit your return electronically for processing.

What records should I retain after filing my IRS 1120?

After filing your IRS 1120, it's essential to keep a copy of your return and any supporting documents for at least three years. This retention period is crucial in case of an audit or if you need to reference your submission in the future. Ensure that these records are stored securely to protect sensitive business information.

Can I use e-signatures for my IRS 1120?

Yes, e-signatures are acceptable for electronically filed IRS 1120 forms, as long as you comply with IRS guidelines regarding authentication and consent. This streamlines the process of submitting your return while maintaining compliance with federal requirements.

What should I do if I receive a notice from the IRS after filing my 1120?

If you receive a notice or letter from the IRS concerning your filed IRS 1120, carefully read the correspondence to understand its context. Respond promptly with the required information and any documentation requested. Consulting a tax professional may also be beneficial to ensure a proper handling of your response.

See what our users say