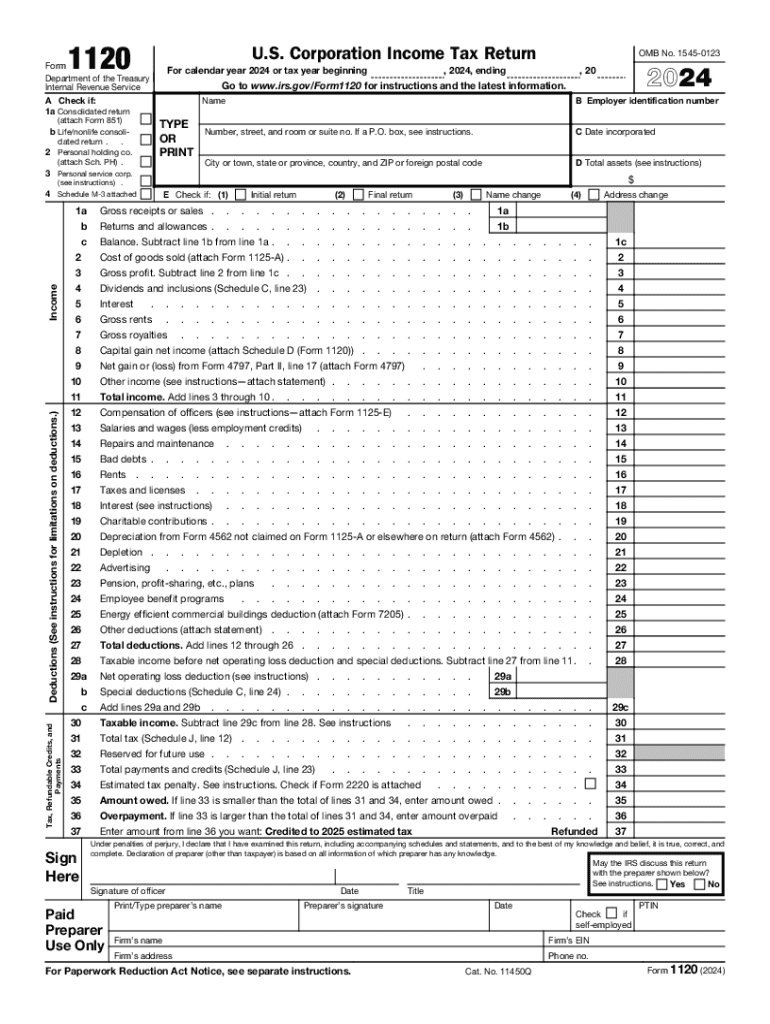

Who needs a form 1120?

Form 1120 is one of the basic entity returns for reporting business income and related taxes to IRS. Any C Corporation operating under federal tax law in the United States needs form 1120 to report annual income. C Corporations are any corporation that is “for profit” with incoming revenue. It is taxed separately from its owners.

What is form 1120 for?

IRS 1120 Form is used to document and report income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation.

Is it accompanied by other forms?

You can use the 1120X Form, Amended U.S. Corporation Income Tax Return, to correct a previously filed 1120 Form.

When is form 1120 due?

Corporate tax returns are always due on the 15th day of the third month, following the close of the tax year. If the due date falls on a Saturday, Sunday, or legal holiday, the corporation can file on the next business day. This tax year Form 1120 is due April 17, 2017.

How do I fill out a form 1120?

U.S. Corporation Income Tax Return consists of 5 pages. On the first page you must provide general information about the corporation and fill out a table of income, deductions, tax, refundable credits and payments. The second page is Schedule C, Dividends and Special Deductions. The third page contains Schedule J, Tax Computation and Payment. You can use Schedule K on page 4 for additional information and Schedule L on page 5 as Balance Sheet per Books.

Where do I send it?

Send it to the closest IRS office in your area or file it electronically at the IRS official website.